Security

For 15 years, we have been consistently building the credibility of our website.

A stable company

-

InternetowyKantor.pl has been operating continuously since April 2010. The website operator is Currency One joint-stock company with a share capital of PLN 3,450,000.

-

The company is licensed by the Polish Financial Supervision Authority to provide payment services. This means that the company is in good financial condition, and the funds for payment transactions are protected because they are in separate accounts and are excluded from the bankruptcy estate. More about the licence»

-

Our customers exchange over PLN 4 billion annually.

-

We employ specialists who ensure proper functioning of the website, its development and security.

-

Our security features have been appreciated by the bankier.pl portal, which awarded us the main prize in the category of “Security – best Fintech practices” in the Złoty Bankier ranking.

Transaction security

-

InternetowyKantor.pl is secured with an Extended Validation SSL certificate. All data sent between our website and customers are encrypted. Data transmission security is certified by GeoTrust.

-

Comfort and security of transaction execution are the cornerstone of our operations, which is why we place great emphasis on the development of transaction security measures within our service. All operations are constantly monitored for proper execution by our transaction security monitoring team.

-

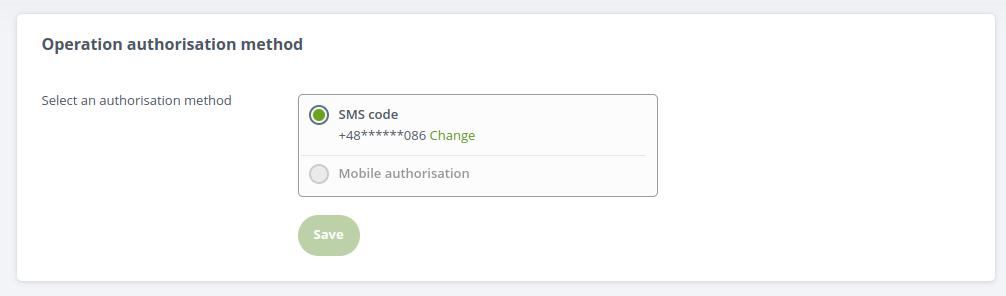

We provide Users with SMS authentication and mobile authorization, which significantly increases data and transaction security.

-

We run security tests at regular intervals and also through the entire software development process.

By the letter of the law

-

We care about the good name of our Company and the entire online currency exchange industry, which is why we comply with the procedures imposed on the financial sector by Polish and international law, in particular the provisions of the Act of March 1, 2018 on Counteracting Money Laundering and Terrorist Financing.

-

Under the Act, we are obliged to collect and submit certain information to the General Inspector of Financial Information (GIIF). GIIF is a government administration body responsible for obtaining, collecting, processing and analysing information in the manner specified in the Act on Counteracting Money Laundering and Terrorist Financing, preventing the introduction of assets from illegal or undisclosed sources into financial circulation and counteracting terrorist financing.

-

Resulting from the above obligations are three key requirements: customer identification and verification, ongoing monitoring of customers and transactions (in terms of money laundering risk) and suspicious occurrences reporting.

-

We are required to collect personal information and identity document features from all our customers. In addition, in the case of institutional customers, we also collect company registration data. We check the compliance of these data with the information identifying bank transfers. In justified cases, we may need to ask you for additional documents or explanations.

-

We constantly monitor transactions. We report transfers above the equivalent of EUR 15,000 and all those transactions for which there is a reasonable suspicion of money laundering or terrorist financing.